A profound transformation is underway in the world’s electrical systems, driven by the rapid rise of artificial intelligence (AI) and its insatiable demand for computing power. In many ways, it resembles a new industrial revolution – data centres and supercomputers have become the factories of the digital age, drawing enormous amounts of electricity and reshaping how and where we produce and use energy.

This shift is especially visible in the Nordic countries, where clusters of AI-focused data centres now sit beside renewable power sources, and even in traditional tech hubs around the globe. The changes go far beyond higher electricity consumption: waste heat from servers is being captured to heat homes and greenhouses; massive electric boilers and hot water reservoirs store surplus renewable energy; and data centres are increasingly seeking self-sufficiency with on-site power plants. Energy professionals, investors, and policymakers are all grappling with this new landscape in which digital infrastructure and energy infrastructure merge. AI and supercomputing are triggering a revolution in power systems – from Finland’s pioneering examples to broader Nordic, European and global trends. This has a major impact on sustainable energy, industrial policy and the future of the grid.

Surging Electricity Demand from AI and Data Centres

The boom in AI and high-performance computing has led to skyrocketing electricity demand from data centres worldwide. According to the International Energy Agency, global data centre power use is set to more than double from current levels by 2030, reaching about 945 terawatt-hours (TWh) annually – slightly more than the entire electricity consumption of Japan. Crucially, AI workloads are the primary driver of this growth: electricity demand from data centres running AI is expected to quadruple by 2030. In advanced economies, this marks a dramatic reversal of trends – after years of stagnation or decline in power demand, data centres are putting the grid back on a growth trajectory. For example, in the United States, data centres are on course to account for almost half of the growth in electricity demand through 2030. By that year, the US is projected to use more electricity for processing data than for manufacturing all energy-intensive goods – like aluminium, steel, cement and chemicals – combined. This jaw-dropping statistic underscores how AI’s rise is creating a new kind of energy-intensive industry, comparable in impact to the factories of the 20th century.

Scrambling to Provide Generation Capacity

In the UK, data centres already consume an estimated 4% of national power, a share that could rise to around 10% by 2030, prompting concerns about meeting climate targets. Meeting this surging demand poses a significant challenge. Data centres require highly reliable,24/7 power to avoid downtime. They also concentrate large loads in specific areas, straining local grids that were not designed for such spikes in consumption. As AI adoption accelerates, countries and companies are scrambling to provide enough generation capacity – especially from clean sources – and to reinforce the transmission networks to deliver power where needed. The IEA notes that a diverse range of energy sources will be tapped to supply data centres’ growth, but renewables and natural gas are expected to lead due to cost and availability. The scale of investments needed is immense: the European Commission’s new InvestAI initiative seeks to catalyse €200 billion in AI and high-performance computing (HPC) infrastructure, with a cornerstone being “AI gigafactories” that combine massive computing power with energy-efficient data centres. In effect, the race is on to build the energy foundations for the AI era – much like railways and power stations were built to enable the industrial era. This race is producing innovative solutions and unexpected shifts in where industries are located, as we will see next.

Powering AI with Clean Energy and Cold Climate

Northern Europe, and especially the Nordic countries, have emerged as pioneers in the new AI-energy nexus. Finland, Sweden, and Norway offer a unique combination of abundant renewable energy, cool climates for efficient server cooling, and well-developed infrastructure, making them attractive locations for energy-hungry data centres. Finland, in particular, is experiencing a data-centre land grab. In 2024, Finland saw 22 new data hall projects announced and at least 15 more in early 2025 – a remarkable surge for a nation of 5.5 million. International tech giants and even crypto-miners have been buying up vast tracts of land for future server farms. The country’s grid operator, Fingrid, reports an astonishing 24,000 MW of new data centre load inquiries – five times the capacity of Finland’s entire nuclear fleet. This reflects the Gold Rush mentality as developers flock to tap Finland’s cheap and green power resources.

Cheap wind power is a big part of the attraction. Finland has undergone a wind energy boom in the past decade: from near-zero a few years ago, installed wind capacity has soared past 8 GW and continues to grow fast. On some windy nights, turbines can meet half of Finland’s electricity demand, driving wholesale prices down to some of the lowest in Europe. In 2023 the Finnish spot price averaged around €56/MWh (only ~60% of the European average), and there were a record 467 hours of negative electricity prices when wind output surged beyond demand. For energy-intensive computing, this is ideal: abundant €30–40/MWh wind power is available via power purchase agreements, providing low operating costs. Moreover, Finland’s cold climate sharply reduces the cost of cooling data centre servers. Most Finnish facilities can use frigid outside air or Baltic Sea water for cooling, achieving power usage effectiveness (PUE) ratios below 1.2, meaning very little extra energy is used beyond the servers themselves. Google’s famous seawater-cooled data centre in Hamina, Finland, operates near a 1.1 PUE, an exceptionally efficient level. In short, Finland offers hyperscale operators a near-perfect pairing: plentiful, cheap, green electricity and free Arctic air-conditioning. Under these conditions, data centres thrive both economically and thermally.

Europe’s Lowest-cost Renewable Power

Sweden and Norway share similar advantages. Northern Sweden, e.g. the Luleå region, hosts large data centres such as Facebook’s server farm, drawn by cheap hydroelectric power and cool weather. Norway, with its vast hydro reservoirs, over 75% of Norwegian hydropower capacity is flexible, markets itself as a home for CO₂-neutral data centres running on 100% renewable energy. Norwegian operators like Green Mountain boast Europe’s lowest-cost renewable power and even use fjord water for efficient cooling. The Nordic countries also benefit from robust digital infrastructure – Finland, for example, has invested in high-speed fibre links, subsea cables connecting Helsinki directly to Germany and Sweden, to ensure that locating servers in the far north does not mean poor connectivity. Latency from Helsinki to Frankfurt is now as low as ~20 milliseconds, comparable to data centres in Central Europe. This means users and investors increasingly see Nordic data centres as well-connected, not remote. One flagship of the Nordic approach is LUMI, the pan-European supercomputer installed in Kajaani, Finland. LUMI, which has ranked among the world’s fastest, is a prime example of combining massive computing with clean energy. It was sited in Kajaani, in an old paper mill hall, largely because of the location’s exceptional score on sustainability and cost – Kajaani offers cheap renewable power, mainly hydropower, existing infrastructure, and the ability to reuse waste heat. LUMI runs entirely on carbon-free electricity, mostly hydropower, and uses innovative cooling that feeds its waste heat into the town’s district heating network. This makes LUMI’s operations extraordinarily low-carbon – indeed, it has been dubbed “the world’s greenest supercomputer”. Locating the machine in a repurposed industrial site saved an estimated 1,000 tons of CO₂ in construction emissions, and once running, virtually all its electricity is renewable, and a significant portion of that ends up heating local homes instead of being wasted. These kinds of synergies between digital tech and clean energy are at the heart of the Nordic strategy, and they illustrate the new paradigm: in the AI era, it is no longer enough for data centres to simply consume power efficiently; the best facilities actively contribute to the energy system, whether by aiding the grid or providing heat to communities. In the next section, we delve deeper into how waste heat from data centres is being turned from a by-product into a valuable resource.

Waste Heat: From By-Product to Valuable Resource

One of the most striking innovations in this energy revolution is the capture and reuse of waste heat from data centres. High-performance servers and AI supercomputers throw off enormous amounts of heat as they process data. Traditionally, this heat was considered a nuisance – something to get rid of via cooling towers or fans. Now, however, countries like Finland and Sweden are treating that excess heat as a commodity that can be harnessed to replace fossil fuels in heating systems. As a result, data centres are increasingly designed not just as electricity loads, but as cogeneration plants that produce useful heat alongside computation.

Finland is a leading example of this trend. Finnish cities have extensive district heating networks – systems of pipes distributing hot water to buildings – which makes it relatively straightforward to inject recovered heat. In the city of Espoo, Finland’s second-largest city, Microsoft is building a large data centre campus with heat pumps that will transfer its server waste heat into the district heating network. When completed, this cluster of data centres is expected to supply about 40% of Espoo’s entire district heating needs, allowing the city’s last coal-fired boilers to be retired. Fortum, the local energy company, calls this project the world’s largest waste-heat recycling scheme: the data centre locations were chosen specifically to enable heat capture using Fortum’s existing 900 km of heating pipes serving 250,000 customers. Fortum estimates the collaboration with Microsoft will cut CO₂ emissions by about 400,000 tonnes per year by displacing coal and gas use in heating. In essence, a future AI supercomputer facility will be warming tens of thousands of homes and offices with “cloud heat”. As Markus Rauramo, Fortum’s CEO, put it, sometimes the most sustainable solutions are simple: “By tapping into waste heat from data centres, we can provide clean heat for homes… and reduce about 400,000 tonnes of CO2 annually”.

Biomass-fired Heating Becomes Obsolete

Another Finnish city, Kajaani, is pushing this concept even further. Kajaani’s local utility (Loiste) is investing tens of millions of euros in new heat pump stations to utilise waste heat from a growing cluster of data centres in an area known as Renforsin Ranta. The first facilities will be operational by late 2025, and by early 2026, the aim is that over 80% of Kajaani’s district heat will come from data centre waste heat. In fact, Kajaani plans to heat almost the entire city with waste heat in the near future. This would make its old biomass-fired heating plant largely obsolete. As of 2023, the LUMI supercomputer and other small data halls provided only about 7% of Kajaani’s annual heating, but with new large data centres, such as a £1 billion campus by XTX Markets, coming online and expanded heat recovery systems, the share will skyrocket in the next couple of years. Loiste’s heat business director notes that if data centres produce more heat than the town needs at any moment, they will have to use free cooling, dissipating heat to the air, but the goal is to use as much as possible and even find new year-round uses for the surplus. To that end, local universities and companies are exploring innovative projects to use waste heat for things like food production and bioprocessing. One idea under study is to establish greenhouses or vertical farms in Kajaani heated by the data centres, which could even allow exotic produce – a Finnish researcher half-jokingly suggested mangoes in Kainuu – to be grown in the subarctic climate. Other concepts include using the heat for fish farming or mushroom cultivation in conjunction with data centre parks. The interest is not limited to Finland: in Sweden, a 9,000 m² greenhouse heated by data centre waste heat is being planned, and in Quebec, Canada, one company (QScale) is building a data centre whose waste heat will annually support the production of 2,800 tonnes of fruit and 80,000 tonnes of tomatoes in adjacent greenhouses. These examples illustrate how what was once considered “waste” can become an enabling resource for local food security and business, creating new revenue streams and community benefits.

Mandating Data Centres to Utilise Their Waste Heat

Policymakers have quickly caught on to the potential. The European Union has moved to encourage and even require heat recovery from large data centres. A recent EU decision, part of the revised Energy Efficiency Directive, will compel data centre operators to assess and report waste heat recovery options, and if viable, to implement them. Member states must transpose these rules by October 2025. Some countries are getting even more aggressive: Germany, in 2023, passed a law mandating that all new data centres utilise their waste heat, with a binding target to reuse 20% of their waste energy by 2028. Finland already offers incentives: data centres above 0.5 MW that reuse heat externally qualify for a vastly reduced electricity tax rate – 98% lower than normal – treating them on par with heavy industries that provide useful cogeneration. This tax break, which made Finland very attractive, is slated to be phased out by the new government in 2025 in favour of more neutral policies, but the widespread adoption of heat reuse suggests the practice will continue regardless. The Nordic advantage in this domain is clear: Southern Europe has little need for heating and lacks district heating grids, so waste heat reuse is not as practical there. Meanwhile, in the Nordics (and other cold regions), a data centre can effectively become a distributed heat plant. As a Swedish researcher, Mattias Vesterlund, noted, the availability of data centres’ excess heat – and ready infrastructure to use it – gives Northern Europe “a really good competitive advantage”. The change in mindset over just a decade is remarkable. In the early 2010s, many district heating companies were sceptical of integrating data centre heat – the temperatures were low-grade and the supply was unconventional. Yet success stories have proliferated: from Stockholm, Sweden, where the city’s Open District Heating initiative invites data centres to sell heat into the grid, with an ambition to supply 10% of the city’s heating by 2035, to Odense, Denmark, where a large Facebook data centre contributes heat to local homes. Even in Paris, a new urban data centre project will channel its heat to a local swimming pool and buildings. Finland’s capital region, after initially hesitating, has fully embraced the concept – Helsinki’s energy company now actively courts data centre heat sources, having seen the world change and technology improve such that even lower-temperature heat can be upgraded via heat pumps. As one Finnish executive quipped, “then the world changed, and now the heat flows” – a nod to how quickly waste heat went from an unwanted by-product to a prized commodity.

Energy-Intensive Tech Hubs and Self-Sufficient Campuses

As AI and data centre growth continues, we are seeing the rise of energy-intensive tech hubs – essentially, modern industrial clusters built around electricity availability, much like mining or steel towns of the past were built around coal or ore. These hubs often combine data centres with other power-hungry processes, like electrolytic hydrogen production for green fuels, or battery factories, or high-tech manufacturing, to maximise the use of local resources. A common theme is aiming for energy self-sufficiency or at least resilience, through the co-location of generation and consumption. There are a few reasons behind this trend:

- Grid constraints and connection delays: In several regions, existing power grids are struggling to accommodate the sudden influx of huge data centre loads. Building new high-voltage transmission lines or substations can take many years, which is far too slow to keep up with demand. For instance, Fingrid in Finland projects national electricity consumption will double by 2035, largely due to data centres and electrification of industry, but warns that each new 400 kV line can take 7–8 years from planning to completion. The surge in southern Finland has already led the operator to impose a temporary moratorium on new major grid connections around Helsinki until 2027, until reinforcements are in place. This echoes a situation in Dublin, Ireland, a few years ago, where a data centre boom forced authorities to pause approvals for new centres to avoid grid overload. In the London area of the UK, the issue has spilled over into other sectors: in west London, new housing developments were told they could not get grid connections before 2035 because nearby data centres had gobbled up all capacity, leading to a high-profile outcry. Such cases are pushing data centre operators to either wait in long queues or find alternatives.

- Locating near energy sources: Given the grid bottlenecks, many new projects opt to locate in areas with existing surplus power infrastructure – often near large power plants or renewable energy sites – even if those locations are remote. We are, in effect, going “100 years back” to an era when industries located themselves next to energy sources. Today’s equivalent might be building a data centre campus next to a hydropower dam in northern Sweden or Norway, or near a cluster of wind farms in sparsely populated western Finland. By being close to generation, these facilities can access high volumes of power without needing massive new transmission lines, and often at lower cost. For example, a new “Polar” data centre announced in Telemark, Norway, sits with direct access to a major hydroelectric grid node for reliable, clean power. In Finland, some municipalities in windy coastal areas (which traditionally had little industry) are eagerly courting data centre investors, advertising their available grid capacity and cool climate – effectively turning former paper-mill towns into data hubs.

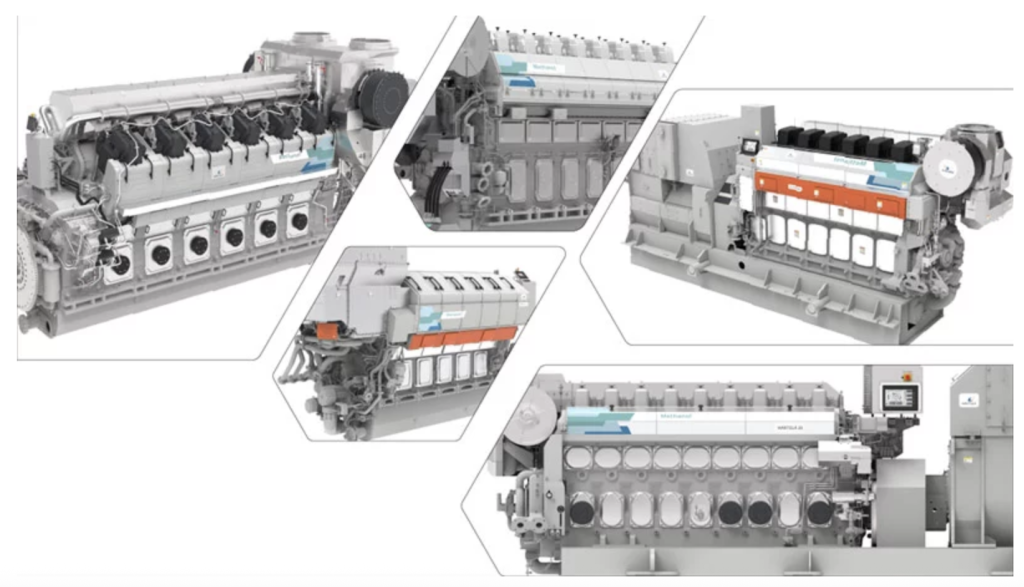

- On-site power generation for reliability: Beyond grid availability, data centres also crave uninterruptible power for security reasons. This has led to a rise in on-site power plants at large data centre campuses, making them partly or wholly self-sufficient. These are typically fuelled by natural gas or other fuels and can run continuously or in backup mode. A notable example is a recent project in Ohio, USA, where a huge new data centre will be accompanied by a dedicated 282 MW engine power plant on-site. The Finnish company Wärtsilä is supplying fifteen gas-fuelled engines for this facility to ensure reliable power delivery directly to the servers. The reason? “Data centre developers are facing increasing time-to-power challenges due to grid connection delays,” explains a Wärtsilä executive. Rather than wait years for a grid upgrade, the developer can get quick power by installing engines. Wärtsilä’s modular gas engines can be manufactured and deployed faster than building new grid capacity, and they offer very high reliability and flexibility in operation. This off-grid solution is seen as not just a stopgap but a potentially “essential answer” for meeting data centre power needs in some cases. Indeed, these modern gas engine plants function like microgrids for data centres: they can run on natural gas today, but are often designed to convert to green fuels like biogas, hydrogen or methanol in the future. In Norway, there have been instances of large data halls pairing with local diesel or gas generators and even small backup liquefied natural gas (LNG) terminals to ensure power availability in remote areas with weak grids. While burning fossil fuels for data centres is not a long-term climate solution, the emphasis is on a transition to cleaner fuels once available. For example, some engine makers are testing dual-fuel setups – Wärtsilä has introduced engines capable of running on methanol, a carbon-neutral fuel if produced from renewable sources. In the marine sector, methanol-fuelled engines are already launching to decarbonise shipping, and the technology is transferable to stationary power. The ultimate vision is that a data centre campus could have its own flexible power plant that initially uses natural gas but later switches to green hydrogen or green methanol, making the whole site fossil-free and even grid-independent if necessary.

- Integration with other industries (energy symbiosis): Some emerging projects seek to create a local ecosystem where a data centre’s presence attracts other electricity-intensive processes so that nothing goes to waste. For instance, an idealised “energy-intensive industrial park” might have: a big wind farm or solar park for primary power; a data centre using most of the electricity and producing heat; a thermal storage facility capturing any excess heat or power; a hydrogen electrolysis plant next door that can ramp up when extra renewable electricity is available (and whose hydrogen could be used to produce methanol or ammonia); and perhaps a greenhouse or drying facility using low-grade heat. Such clusters can flexibly balance energy supply and demand internally. We are seeing early signs of this in places like Northern Finland and Sweden, where companies plan to co-locate hydrogen production and e-fuel plants alongside data centres. One concrete example is in Kristinestad, Finland, where an AI & Hydrogen industrial park has been proposed to leverage abundant wind power – the data centre would consume power when it’s plentiful, while electrolysers turn surplus power into hydrogen, and the oxygen by-product could even be used by the data centre cooling systems or nearby industries. While these plans are in infancy, they demonstrate a new way of thinking: treat energy, computing, and industrial processes as one integrated system. The goal is a kind of circular energy economy at the local level, improving overall efficiency and economics. A data centre’s flexibility can indeed be an asset – for example, it can delay non-urgent computations or pre-cool servers to ride through a grid peak, acting as a demand-response resource. In a similar vein, many large data centres are adding massive battery banks, originally intended as backup UPS systems, that can also function to stabilise the grid by absorbing or supplying power on short notice. Google and others have piloted using their facility batteries to provide frequency regulation services to the grid when not needed for emergencies. All these steps blur the line between power plant and data centre.

The outcome of these trends is that we are witnessing the birth of self-sufficient data campuses and energy-centric tech hubs in various regions. Northern Scandinavia, as noted, now hosts campuses where renewable power plants, data centres, and sometimes fuel production facilities sit side by side. In the United States, some hyperscale cloud providers are investing in their own solar and wind farms or co-locating near large generation – like Google in Alabama near TVA dams, or Microsoft in Wyoming next to a wind farm – to secure their energy supply. Security concerns also play a role: from a resilience perspective, having on-site generation and not being entirely reliant on distant grid infrastructure can protect data centres from outages or even from geopolitical risks. In Europe, the concept of AI Gigafactories promoted by the EU explicitly calls for combining “massive computing power with energy-efficient data centres” – essentially encouraging designs that are deeply intertwined with the energy infrastructure. Finland is actively bidding to host one of these EU-supported AI mega-centres, highlighting its experience with LUMI and the local expertise in keeping such facilities cost-effective, energy-efficient and responsible. The Prime Minister of Finland stated that the nation’s proven ability to provide world-class computing “cost-effectively, energy-efficiently and responsibly” – thanks to things like green power and heat recycling – is a key selling point. This shows that energy considerations are front and centre in decisions about where to place the next generation of AI infrastructure.

Electric Boilers and Thermal Energy Storage

The rise of intermittent renewable energy and the sporadic but massive loads of AI computing are together driving a need for greater flexibility in energy systems. To accommodate this, a wave of new energy storage and conversion solutions is being deployed – often at or near these new industrial hubs. A prominent example is the use of electric boilers and thermal energy storage to bridge the power and heat sectors, which has seen significant investment in the Nordic region.

In Helsinki, Finland’s capital, the utility Helen is constructing what will be Europe’s largest electric boiler plant coupled with a huge hot water storage facility. This project, at the site of a decommissioned coal power plant in Hanasaari, consists of four electric resistance boilers totalling 200 MW of thermal output, and two cylindrical heat storage tanks reaching about 40 metres high with a combined capacity of 1,000 MWh of heat storage. The concept is straightforward: when electricity is abundant and cheap, for example, on a windy night, the giant “water heaters” will switch on and convert power to heat, storing it in the hot water tanks. Later, when heat demand is high, or electricity is expensive, that hot water can be released to supply the district heating network of Helsinki. The system can charge or discharge up to 100 MW of heat, offering a massive buffering capability. This approach effectively stores electricity in the form of heat, which is far more economical for large energy quantities than using batteries. By integrating the electricity and heating sectors, Helen aims to provide important flexibility that benefits both: the stored heat insulates customers from volatile energy prices and can replace fossil fuels in heat production, while the ability to soak up excess power helps balance the grid during peaks of renewable generation. The Helsinki electric boiler plant is expected to come online by the 2026–2027 heating season and is among the largest such installations in the world. Helen’s strategy also includes utilising “all kinds of waste heat, air, water and electricity” to achieve carbon-neutral heat production by 2030, underscoring how electric boilers fit into a broader shift away from combustion-based heat.

Mega Cave of Seasonal Heat

A similar and even more ambitious project is underway in Vantaa, a city neighbouring Helsinki. Vantaa Energy has begun excavating what it calls a “mega cave” – the world’s largest seasonal heat storage facility, deep in the bedrock near a major highway. This will consist of a system of vast underground water-filled caverns, collectively as big as five parliament buildings in volume, where water can be heated up to 140 °C and stored for months. During summertime, when electricity is often cheap and there’s surplus heat, including waste heat from power plants and industry, the water will be heated and pumped into the sealed rock caverns. In winter, the stored heat can be extracted to supply district heating for Vantaa and even neighbouring municipalities. To charge this giant thermal battery, Vantaa Energy is installing two 60 MW electric boilers – essentially enormous immersion heaters – which can be ramped up on a schedule of minutes to take advantage of the cheapest hours of electricity. The goal is to use power when it’s abundant and “free” – sometimes Finland’s spot price falls to zero or negative due to high wind output – and to generate heat when it’s needed most. Once completed in 2028, this seasonal storage will hold enough energy to significantly reduce – and eventually eliminate – the use of fossil gas and oil in Vantaa’s heating mix. The CEO of Vantaa Energy noted that if the electric boilers were operational today, “they would likely be used right now instead of, for example, biofuel,” because the electricity price dips make direct electric heating more economical at times. In other words, even wood-burning could become uncompetitive when you have large, flexible electric heat sources – a telling sign of the changing times – indeed, Helsinki and other Finnish cities are also pivoting away from wood biomass for urban heat in favour of heat pumps and electric storage, partly due to air quality and sustainability concerns.

Softening Price Spikes

From a grid perspective, these developments are very significant. Fingrid, the Finnish grid operator, has welcomed the spread of big electric boilers and heat pumps. Mikko Kuivaniemi, who leads Fingrid’s balance management unit, observed that Finland now has nearly the equivalent of a small nuclear reactor’s capacity in electric boilers installed or planned, and “they already have a big impact on electricity adequacy and price formation”. Essentially, when there’s a lot of wind power, these devices can soak up the excess, preventing wasteful curtailment of renewables, and when there’s a cold lull, the stored heat can alleviate the strain on power stations. It’s still a new phenomenon – Kuivaniemi admitted that even experts don’t yet know exactly how a large fleet of electric boilers will alter market dynamics, since “in this scale they are quite a new phenomenon”. But the expectation is they will soften price spikes and improve overall efficiency. He even suggested that Finland could triple its energy storage, in various forms, to further enhance stability. This thinking aligns with Europe’s broader push for sector coupling – linking electricity with heating, cooling, and transport – to better utilise renewable energy.

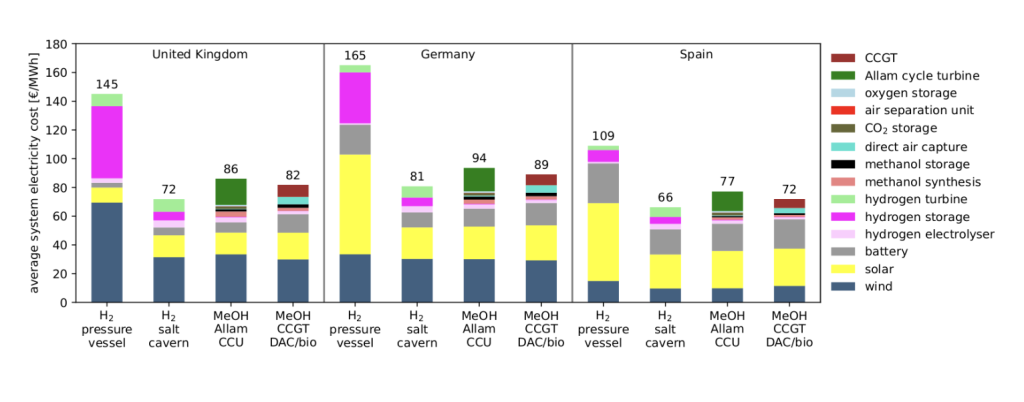

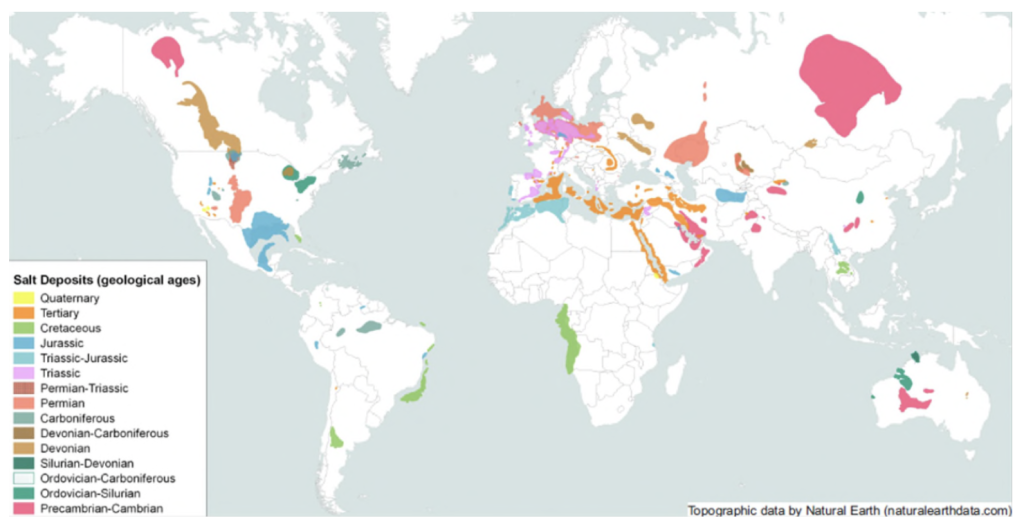

Another frontier of energy storage emerging from this revolution is the use of green methanol as a long-duration storage medium. Methanol, a liquid alcohol, can be produced from renewable hydrogen combined with captured CO₂, and crucially, it is much easier to store than hydrogen gas. Researchers have pointed out that, as a liquid fuel at ambient conditions, methanol can be kept in ordinary tanks and shipped or pumped using existing infrastructure. “Methanol presents a nice alternative to hydrogen, since as a liquid you can store it in tanks anywhere,” says energy expert Tom Brown, noting that hydrogen usually needs specialised salt caverns or high-pressure vessels that limit where it can go. A single large tank – say 200,000 m³, which is not unusual in the petrochemical industry – could store on the order of 880 GWh of energy in methanol – an astronomical amount, far beyond any battery installation. The vision here is that during periods of massive renewable surplus, e.g. very windy weeks or months, excess power can be used to produce green hydrogen and then synthesise methanol, which can be stockpiled for months or even seasons. When needed, the methanol can be burned in turbines or engines to regenerate electricity, ideally capturing the CO₂ again in a closed loop. The round-trip efficiency is not high – roughly 35% efficient in energy terms – but for seasonal storage, that may be acceptable if the alternative is curtailing huge amounts of renewable energy. Importantly, we will likely need methanol and similar e-fuels for sectors like shipping and aviation anyway, so developing this pathway could serve multiple purposes.

Cleaner Methanol-fuelled Generators

This ties back to AI and data centres, possibly in two ways: First, data centre campuses with on-site generation might choose methanol as a future fuel. Instead of diesel backup generators, one could have methanol-fuelled generators that are cleaner and whose fuel can be produced synthetically – achieving reliable power and decarbonisation. Already, companies like Wärtsilä are ensuring their engines can run on a variety of sustainable fuels– their newest multi-fuel engines can use natural gas, biogas, and have versions for methanol and even ammonia in development. Second, at a grid scale, if green methanol storage becomes common, it provides a cushion of dispatchable energy that can cover the kind of multi-day or seasonal lulls that neither batteries nor demand response can easily handle. This, in turn, makes it easier to support the huge new electricity loads, like data centres, reliably with 100% renewable supply. In Germany, energy firms and researchers are now seriously examining methanol-based storage as a strategic option for the 2030s, precisely because hydrogen storage is geographically limited and new nuclear is politically difficult. An IEEE Spectrum report noted that methanol’s ease of storage means you can site the storage anywhere – not just where there’s a salt cavern – potentially bringing “ultra-long-duration energy storage anywhere”. If one imagines an “AI city” of the future with dozens of data centres powered entirely by wind and solar, one could also imagine fields of solar panels, rows of wind turbines, and a tank farm of methanol or ammonia providing the guaranteed backup for when the sun and wind falter. These elements together – smart loads like data centres, flexible conversion to heat, and chemical fuel storage – may form the backbone of a fully renewable yet highly reliable energy system supporting our digital society.

Rethinking Global Strategies

The confluence of AI and energy is prompting policymakers to rethink strategies on multiple fronts: industrial policy, energy infrastructure investment, climate goals, and even geopolitics. Governments are keen to attract AI and data centre investments given their economic significance, but they are also realising that without proactive planning, the energy impact can be problematic – from hitting carbon targets to preventing local capacity crunches. The EU is integrating data centres into its climate policies, through efficiency and waste-heat mandates, and also into its digital sovereignty agenda, through initiatives like the European AI Gigafactory proposals. In April 2025, the European Commission unveiled its AI Continent Action Plan, with a flagship goal of creating world-class AI infrastructure in Europe. A cornerstone of this plan is establishing a network of AI innovation hubs with enormous computing capacity – but explicitly tied to energy-efficient data centre design. Europe wants AI growth without a spiralling energy and carbon cost, hence the focus on efficiency and using clean energy. Finland’s bid to host an EU-backed AI gigafactory alongside its existing LUMI supercomputer exemplifies this: the project emphasises combining “massive computing power with energy-efficient data centres” to provide globally competitive capacity in a sustainable way. Finnish officials highlight that they have “everything necessary to drive European leadership in AI” – not only technical expertise and R&D, but also green energy, cool climate, and experience in heat recycling to make these facilities sustainable. The business model of future AI centres thus inherently includes energy and environmental performance, not just raw computing.

AI as a Tool for Energy Efficiency

Across the Atlantic, similar discussions are happening. The U.S. government has begun studying the energy implications of AI. States like Virginia, home to Data Center Alley, are wrestling with grid upgrade costs and considering requirements for new data centres to invest in renewables or energy storage to mitigate their impact. On the positive side, AI is also being seen as a tool to improve energy efficiency – for instance, AI can optimise grid operations, enhance energy storage management, and reduce waste in buildings and transport. The IEA’s 2025 report noted that while AI-driven data centres will increase power demand, AI itself could help cut costs and emissions elsewhere, potentially even offsetting the increase through efficiency gains if adopted widely. There is thus a clear incentive for policymakers to encourage synergy: require AI infrastructure to be as green as possible and simultaneously leverage AI to accelerate the clean energy transition.

The global picture shows a divergence: some regions with cheap coal or gas might be tempted to power AI growth the “old way”, just adding more fossil power plants, but they will increasingly find themselves at a competitive disadvantage. Technology firms themselves have strong climate commitments – hyperscalers like Google, Microsoft, Amazon, as well as many AI startups, have pledged to use 100% renewable energy and aim for carbon-neutral or carbon-negative operations. They are actively seeking locations and solutions that align with those goals. This is why you see, for example, Microsoft signing deals to buy fusion reactor capacity for its data centres in the 2030s, or experimenting with hydrogen fuel cells for backup instead of diesel. Every major data centre operator is also investing in energy storage, from big batteries to gravity storage trials, to ensure that renewable power can meet their 24/7 needs.

Data Centres are Strategic Infrastructure

In some developing countries, the surge in data centre investment is actually helping drive renewable energy growth. For instance, Singapore has constrained land for renewables, but its data centres are exploring offshore solar and importing green energy from neighbours. India and Indonesia are courting data centre projects on the condition that a portion of the power comes from new solar/wind farms. Meanwhile, hyperscale AI clusters in places like Qatar or Saudi Arabia, which see themselves as future tech hubs, are being paired with massive solar arrays in the desert to ensure the power is both cheap and clean, rather than using more of their oil or gas for it. The energy intensity of AI is influencing trade and diplomacy too – discussions of a Carbon Tariff or digital services tax could eventually factor in the carbon per teraflop of computing, pushing companies to locate AI workloads in greener grids. Finally, there is a security and resilience angle: Data centres, especially those serving government or critical industries, are being treated as strategic infrastructure. During crises, like extreme weather or conflicts, we will depend on them to keep information flowing. Thus, their energy supply must be ultra-resilient. Nations are likely to invest in hardening the power supply for key computing nodes – whether through islanding capabilities, able to run off-grid in an emergency, duplication across regions, or even small modular reactors (SMRs) dedicated to powering important data centres in the future. For example, there are proposals in the UK to use SMRs to support energy-intensive industry clusters, which could include big data and AI facilities. While nuclear hasn’t been a focus of our discussion, Nordics have limited new nuclear plans aside from Finland’s recent OL3 reactor; some view advanced nuclear as a complement to renewables for powering AI: always-on, zero-carbon power for critical loads. However, given the long timelines and public acceptance issues, most near-term activity is on the renewable and storage front.

Deeply Interwoven Energy and Digital Technology

The advent of AI and ubiquitous computing is driving an energy revolution that is as much an opportunity as it is a challenge. We are witnessing the emergence of a new paradigm in which energy and digital technology are deeply interwoven. Data centres – the engines of the AI economy – are becoming anchors of local energy systems rather than just consumers. They gravitate towards energy sources, catalyse infrastructure upgrades, and even transform into energy suppliers themselves by providing heat and grid stability services. In the Nordic countries, these changes are already tangible: towns once known for paper mills or mining now host clusters of servers, and the waste heat from computational processes is heating homes, greenhouses, and industrial processes in an elegant symbiosis. Massive hot water tanks and rock caverns store the excess energy from windy days to be used in cold winters, ensuring that not a watt is wasted in this new ecosystem.

On a global scale, the places that manage to align tech growth with smart energy planning will reap the benefits – attracting investment while meeting climate goals. Those that don’t may face bottlenecks or backlash. A data centre project can no longer be conceived in isolation from its power source: power purchase agreements, grid studies, and sustainability plans are now front and centre in these investments. We are effectively seeing a convergence of roles: power companies talk about data and AI, while tech companies delve into energy procurement and storage. Policymakers, for their part, are starting to require that new digital infrastructure contribute to, rather than undermine, the clean energy transition.

Decentralisation, Integration, and Innovation

This energy revolution is characterised by decentralisation, integration, and innovation. Energy-intensive industries of the past clustered around coal mines and waterfalls; today’s AI data centres cluster around renewable-rich grids and even create “virtual power plants” of their own. Electric grids that once delivered one-way power now interact in complex ways with flexible consumers and storage that blur the line between demand and supply. And the very definition of efficiency is expanding – it’s not only about PUE or FLOPS per watt, but about using every output of the system, including heat, productively and minimising the environmental footprint. The fact that a single AI supercluster can heat a city or that a cooling innovation can save as much CO₂ as a wind farm underscores the scale of change. Investors and engineers are learning that success in this space requires a holistic approach: when evaluating a new AI Park one must weigh the local grid capacity, renewable integration, heat reuse options, and community impact just as much as the computing specs. Energy professionals are, in turn, learning to treat large data centres not just as loads to serve but as potential partners that can help balance and finance new infrastructure. For general audiences and policymakers, the key takeaway is that the AI revolution and the green energy revolution are two sides of the same coin – they will either advance together in a virtuous cycle, or clash. Thankfully, as the examples from Finland and beyond show, the emerging model can be a win-win: where AI’s growing power demands are met in ways that accelerate the decarbonisation and modernisation of energy systems. It is a fascinating, dynamic time at this crossroads of high tech and energy, and what we are building now – from self-heating cities to self-powered data fortresses – may well be looked back upon as the foundation of a truly sustainable digital age.

Read More:

- International Energy Agency: AI is set to drive surging electricity demand from data centres while offering the potential to transform how the energy sector works

- Yle News: Kajaani lämpenee tulevaisuudessa datakeskusten hukkalämmöllä: Loiste sijoittaa kymmeniä miljoonia euroja Renforsin rantaan (Kajaani will in future be heated by data centers’ waste heat)

- Yle News: Uudet datakeskukset loivat erikoisen mahdollisuuden: Kainuussa voisi kasvattaa tulevaisuudessa mangoja (New data centres created an odd opportunity: growing mangoes in Kainuu)

- Yle News: Datakeskusten hukkalämpöä on pian pakko hyötykäyttää, ja Suomella on siihen tarkoitukseen hyvä kohde (Data centers’ waste heat must soon be utilised, and Finland has a good target for it)

- Medium: How Wind-Powered Finland Became Europe’s New Data-Centre Darling

- Wärtsilä: Wärtsilä engines selected to deliver reliable power for U.S. data center

Wärtsilä: Choosing a methanol engine for your newbuild vessel - Helen (Helsinki Energy) News: Helen rakentaa Hanasaareen Euroopan suurimman sähkökattilalaitoksen (Helen builds Europe’s largest electric boiler plant in Hanasaari)

- Yle News: Vantaa louhii ainutlaatuista megaluolaa lämpövarastoksi ja nappaa hyödyn ilmaisesta sähköstä (Vantaa digs unique mega-cave for heat storage to harness free electricity)

- Tom Brown: Methanol for ultra-long-duration energy storage

- Finnish Government: Finland aims to host a European AI gigafactory

- Cruise Industry News: Wärtsilä Introduces Four Methanol Engines

- DCD: Polar announces new AI-ready data center powered by 100 percent renewable energy in Norway

- DCD: UK data center power demand to jump six-fold in ten years, National Grid CEO warns

- The Guardian: Capacity crunch: why the UK doesn’t have the power to solve the housing crisis